Contracted Hours

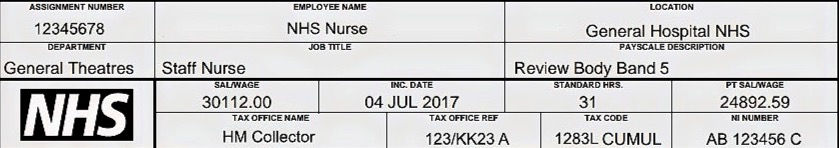

You can find your contracted hours on your NHS payslip under '

STANDARD HRS'

The hours you enter into the '

Trust Contracted Hours' box on our application form

must be rounded up to the nearest half hour.

For instance:

- If your payslip says your Standard Hours are 37.75, you would round this up to 38.

- If your payslip says your Standard Hours are 42.25, you would round this up to 42.5.

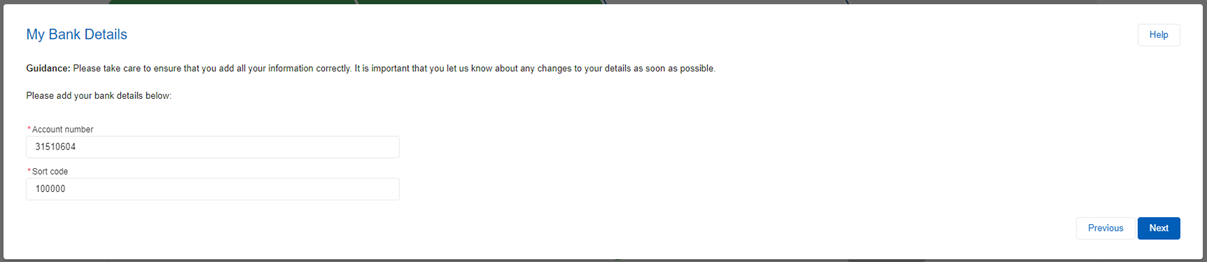

Bank Details

Please enter your account number and sort code into the boxes provided

If your bank details are incorrect, you will not be paid on time.

If your bank details are incorrect, you will not be paid on time. Please check your details are correct on the next screen before clicking '

Next'.

If you notice any of your details are incorrect

If you notice any of your details are incorrect, please click '

Change Details' and try again.

If any of your bank details change, please let us know as soon as possible to avoid your pay being delayed. For more information, see our article

My bank details have changed

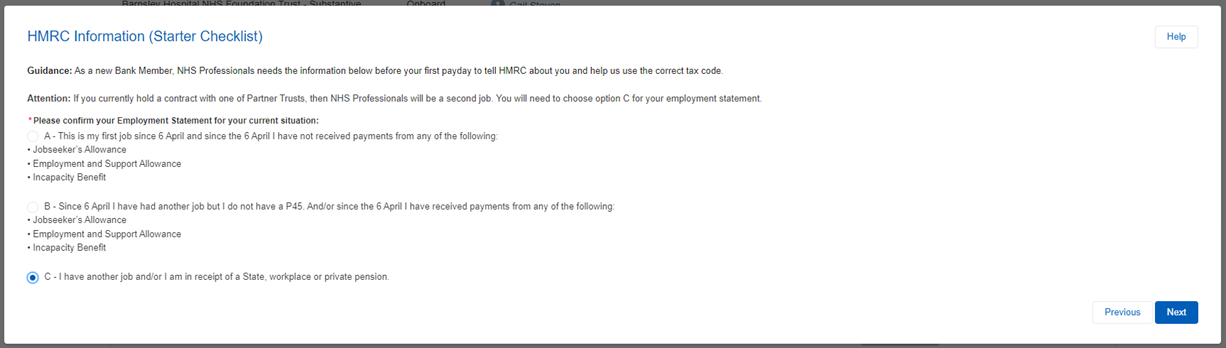

HMRC Information

We can't tell you what your Tax Code should be - this is decided by HMRC and is informed by how you answer our

HMRC Information questions. It's really important to select the correct HMRC Tax and Student Loan Statements when completing your application form. If you don't, you may be charged the wrong amount of tax and Student Loan repayments each month as your Tax Code may end up being incorrect.

Please choose whichever of the options provided best fits you.

To help you with choosing the correct option, we have a few questions that may help you:

Do you have another job?

- If you have another job, please choose Option C

- This includes if you have a Substantive role in one of our Partner Trusts or Clients

- If you don't have another job, please move on to the next question

Do you receive payments from a pension?

- If you receive any pension payments, please choose Option C

- This includes:

- State pensions - a pension paid when you reach State Pension age.

- Workplace pensions - a pension which was arranged by your employer and is being paid to you.

- Private pensions - a pension arranged by you and is being paid to you

- If you don't receive any pension payments, please move on to the next question

Have you received any other relevant payments since 6 April?

- A 'relevant payment' is any payment from:

- another job which ended after 6 April

- Jobseeker's Allowance (JSA) - an unemployment benefit which can be claimed while looking for work.

- Employment and Support Allowance (ESA) - a benefit which can be claimed if you have a disability or health condition that affects how much you can work.

- Incapacity Benefit - help if you could not work because of an illness or disability before 31 January 2011

- No other Government or HMRC paid benefits need to be considered

- If you receive a 'relevant payment', please choose Option B

- If you don't receive any 'relevant payments', please choose the statement Option A

If you have a Student Loan, please see our article

How do I input my student loans details?